Get the latest Market Price for your property values

The 2024 Depreciation Tables are available!

Contact UsDefend Your Determination of Value based on Actual Market Data

Ensuring you have accurate data you need to complete and defend your determination of value

Accuracy

When you need the value of your equipment, shouldn't it be based on what someone would pay for it in today's market place? So, it is best to use the most relevant data provided by our tables

Verifiable Data

Unlike, legacy databases provided by the industry, our data is based on actual sales comparables and tested with actual comparable sales appraisals. We scour the market for the latest sales data.

Easy Calculations

Methodology from America's largest and most prestigious equipment society - American Society of Appraisers and the International Association of Assessing Officers (IAAO).

REPORT THE TRUE FAIR MARKET VALUE

PTRS has developed depreciation schedules which estimates the decline of the subject’s value over time. This provides our customers with Fair Market Value (FMV) that is credible based on methodology developed by the American Society of Appraisers and the IAAO.

Nearly, all equipment depreciation tables used today are based on survival studies (eg. Marshall & Swift) and do not account for obsolescence found in equipment. PTRS Depreciation Schedules are based on economic useful life, which estimates all forms of deprecation found in any equipment type (physical, functional, and economic).

An asset’s economic life gives our customers a true FMV or a creditable value, according to Uniform Standards of Professional Appraisal Practices (USPAP).

Introducing the most advanced methodology in Personal Property Valuation

PTRS PERSONAL PROPERTY DEPRECIATION SCHEDULES

Based on Thousands of New & Used Sales

With over 30 years of experience determining the value of equipment and machinery, we have developed a proprietary method of data collection that we’re now opening up to the marketplace.

Thousands of Data Points and Growing

Our database already contains most of the machinery and equipment, covering 32 market segments, with new line items added every year and data refreshed for the most accurate valuation of your personal or commercial property for determining its true tax value.

Easy to Incorporate into Workflow

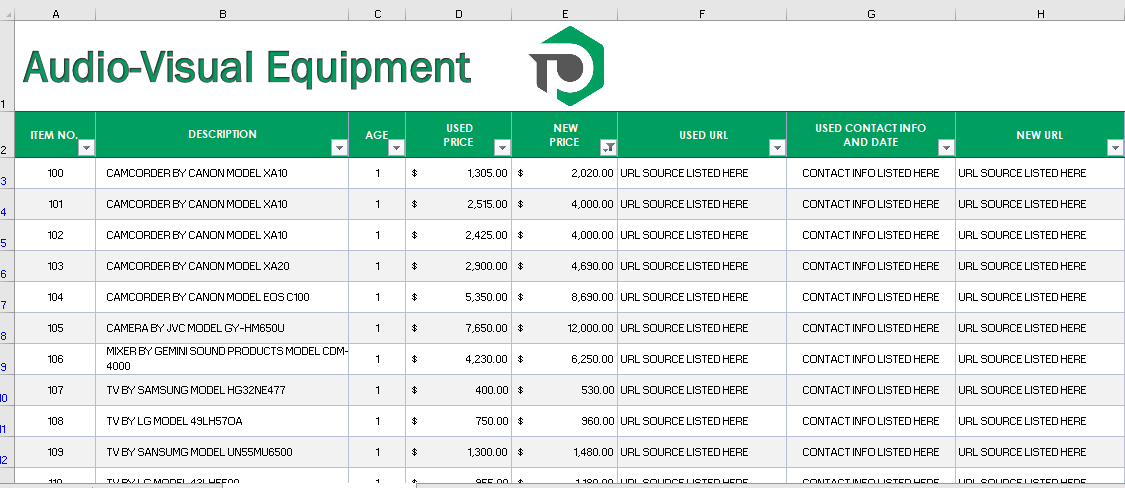

The easy-to-use PTRS Depreciation Schedules can be converted to a Microsoft Excel file format, so it’s easily incorporated into your everyday work flow without further training or conversion.

Commercial and Personal Property Equipment Categories

Fair market depreciation schedules in dozens of categories

- Audio Visual Equipment

- Automobile Production

- Brewing Equipment

- Casino Gaming Equipment

- Computers

- Construction Equipment

- Construction - Caterpillars

- Convenience Stores

- Fast Food

- Forklifts

- Gas Station & Repair Shops

- Grocery Retail

- High-Tech Production

- Hotel & Motel

- Kitchen Equipment

- Light Duty Trucks

- Medical Equipment

- Medical Production

- Metal Manufacturing Equipment

- Network Equipment

- Office Equipment

- Office Furniture

- Pharmacy Retail

- Plastic Manufacturing

- Point of Sale Equipment

- Production / Manufacturing

- Production / Manufacturing & Warehouse

- Refrigeration

- Repair Shop

- Restaurant Equipment

- Retail Store Fixtures

- Security

- Servers

- Signs

- Tractor / Trailers

- TV Production

- Warehouse

Used by Majority of Industries

Appraisers

Lending Institutions

Leasing

-

Establish Current Fair Market Value

-

Determine Future Residual Value

-

Documented Evidence of Value

-

Efficient Method to Value Large Groups of Equipment

Ad Valorem Tax Professionals

Government Tax Agencies

Accountants

-

Documented Verification of Asset Values

-

Proven Method Used in Tax Appeal Cases

-

Physical Depreciation Schedules versus Actual Market Values

-

Ideal for Mass Appraisals

Insurance Companies

Buyers- Sellers

Owners

-

Determine Current Value or Depreciated Replacement Cost

-

Expedite and Resolve Claims

-

Actual Market Values versus Guesstimates

-

Streamline Value Process